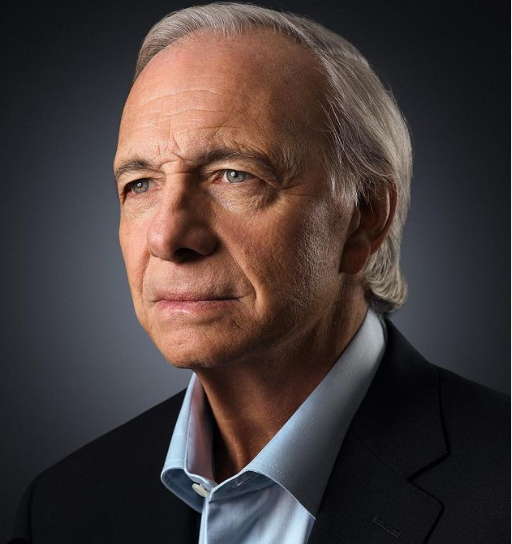

Ray Dalio is a renowned figure in the world of finance and investing, known for his remarkable contributions to macroeconomic policies and investment strategies. His innovative ideas have left a significant impact on the global financial sector and continue to shape the way institutions approach investing. This article delves deep into the life, career, and achievements of Ray Dalio, the founder of Bridgewater Associates – the world’s largest hedge fund.

Ray Dalio’s Early Life

Ray Dalio was born into a middle-class family. He developed a keen interest in the financial markets at a young age, and his passion for finance led him to start investing at the tender age of 12. He used the tips he received from golfers while caddying to invest in the stock market. Ray’s academic journey took him to Harvard Business School, where he completed his MBA in 1973. This time at Harvard provided him with a solid foundation in finance, setting the stage for his groundbreaking career in investment management.

Founding of Bridgewater Associates

In 1975, armed with an MBA from Harvard and a burning passion for finance, Ray Dalio started Bridgewater Associates from his two-bedroom apartment in New York City. Over the years, he has successfully built Bridgewater into the world’s largest hedge fund, managing a staggering $124 billion. Bridgewater’s success can be attributed largely to Ray’s unique investment principles and the firm’s distinctive culture of ‘radical transparency.’

Investment Innovations

Throughout his career, Ray has introduced several groundbreaking investment strategies that have revolutionized the financial industry. Some of these include the risk parity strategy, alpha overlay, and the All-Weather strategy. These innovative approaches have changed the landscape of institutional investing and continue to be widely adopted by investment firms worldwide.

Bridgewater’s Influence

Under Ray’s leadership, Bridgewater Associates has grown into a highly influential investment firm. Its innovative investment strategies and unique culture have not only reshaped the investment landscape but also earned it recognition as one of the most important private companies in the United States, according to Fortune Magazine. Besides, Ray’s macroeconomic insights have been sought by policymakers globally, further solidifying Bridgewater’s standing in the financial world.

Ray’s Achievements and Honors

Ray Dalio’s immense contributions to finance and economics have earned him numerous accolades, including several lifetime achievement awards. His influence extends beyond the realm of finance, with TIME Magazine naming him among the “100 Most Influential People in the World.” Today, Ray serves as a mentor and investor at Bridgewater and holds a seat on its board.

Ray’s Published Works

Ray Dalio is also a best-selling author, with his book “Principles: Life and Work” hitting the #1 spot on the New York Times bestseller list. His other notable works include “Principles for Dealing with the Changing World Order” and “Principles for Navigating Big Debt Crises.” These publications encapsulate Ray’s profound insights into economics, investment, and life principles, providing invaluable guidance for individuals and institutions alike.

Philanthropic Ventures

Beyond his achievements in finance, Ray is also known for his philanthropic endeavors. He has donated over $1 billion to various causes through his foundation, Dalio Philanthropies. His philanthropic interests are diverse, ranging from ocean exploration to improving equal opportunity in education, healthcare, and finance.

Ray’s Perspective on Economics

Ray Dalio’s profound understanding of economics is evident in his insightful commentary on global economic conditions. According to Ray, economics is inseparable from money management, and conducting economic research is key to becoming a successful trader. His in-depth studies on the rises and declines of past leading empires offer valuable insights into the current economic, political, and policy situation.

Conclusion

Ray Dalio’s journey from a middle-class neighborhood to the pinnacle of the investment world is a testament to his passion for finance, innovative thinking, and relentless drive. His groundbreaking investment strategies, insightful macroeconomic analyses, and generous philanthropy have left an indelible mark on the world. As he continues to share his wisdom and insights, Ray Dalio remains a beacon of inspiration for aspiring investors and economists worldwide.

FAQs

1. What is the philosophy of Ray Dalio?

Ray Dalio’s principles for successful investing revolve around comprehending market cycles and the workings of the economic system. These principles empower investors to effectively navigate risks and make well-informed choices regarding the timing of their investments in specific asset classes.

2. What is the Ray Dalio’s net worth?

It is estimated to be 1,540 crores USD.

3. Why should you read Principles by Ray Dalio?

If you aim to gain deeper insights into yourself, the world around us, and the route to achieving success, Principles can provide significant assistance and guidance.